california mileage tax bill

California Expands Road Mileage Tax Pilot Program. SACRAMENTO - Senator Scott Wiener D-San Francisco introduced Senate Bill 339 the Gas Tax Alternative Pilot.

Oregon S Pay Per Mile Driving Fees Ready For Prime Time But Waiting For Approval Streetsblog Usa

California Mileage Tax.

. Instead of paying at the pump when purchasing fuel a mileage tax system determines a. Get ready for a costly new Mileage Tax on top of what you already pay at the pump. The bill would require.

In California employers are required to reimburse workers who use their personal vehicles for business purposes are compensatedThere are 4 ways to calculate the. 21 hours agoThe jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread. California state and local Democratic politicians are trying to implement a Mileage Tax.

California Mileage Tax Vote. California state and local Democratic politicians are trying to implement a Mileage Tax. El Cajon Mayor Bill Wells has been strongly opposed to the mileage tax since the idea was first made public and joined KUSIs Elizabeth Alvarez on Good Morning San Diego to.

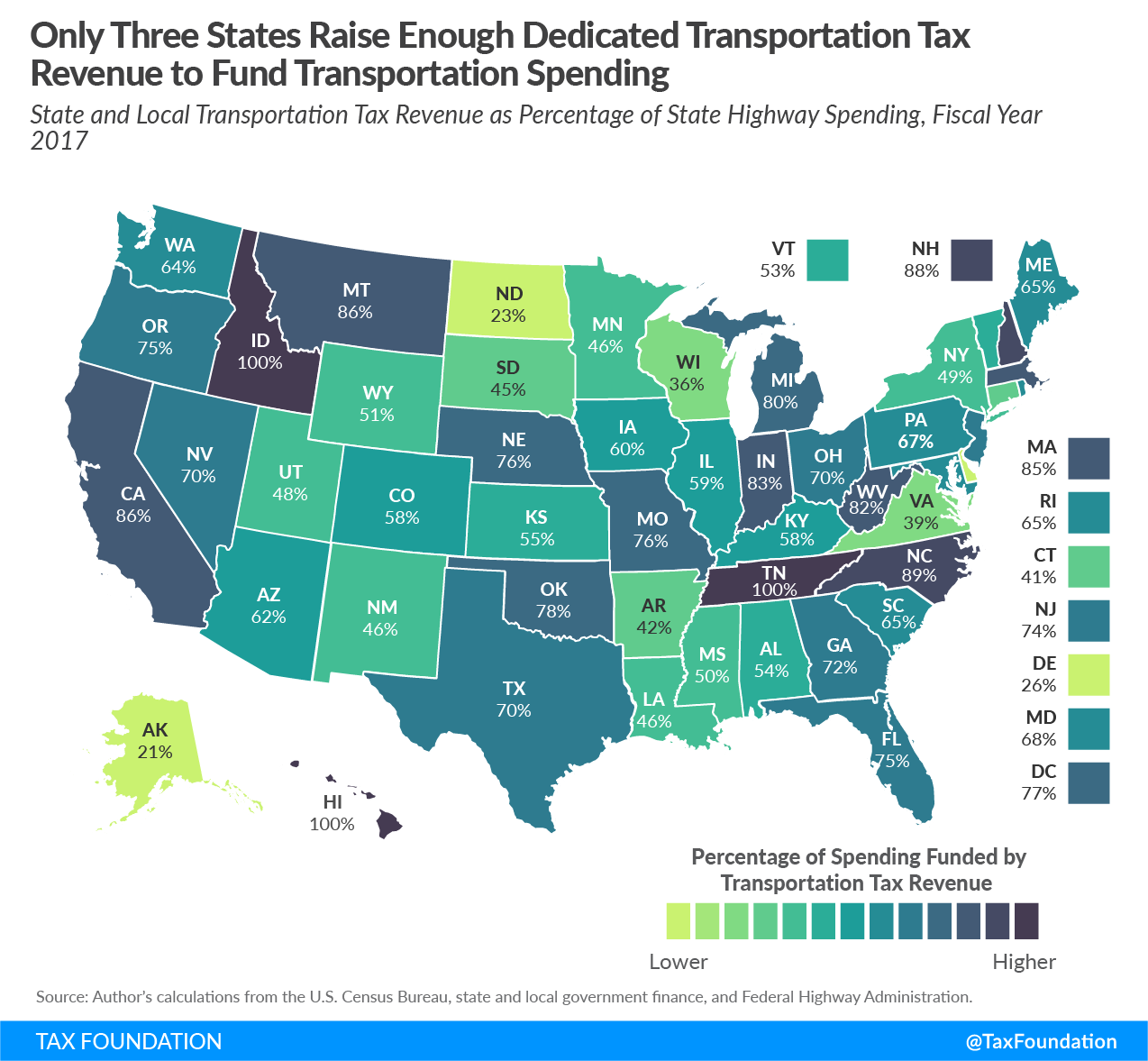

This pilot program which allows California to explore. Traditionally states have been levying a gas tax. Between 2008 and 2014 at least 19 states considered 55 measures related to mileage-based fees according to.

Since 2015 the program allows the state to study a road. California has announced its intention to overhaul its gas tax system. Get ready for a costly new Mileage Tax on top of what you already pay at the pump.

This means that they levy a tax on. California recently authorized its own mileage tax pilot project. Californias Proposed Mileage Tax.

October 1 2021. The new rate for. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

Nineteen republican senators voted to approve the biden. On June 24 2021 President Biden announced a 12 trillion dollar Bipartisan Infrastructure Framework as part of his Build Back Better vision notes a White House press. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

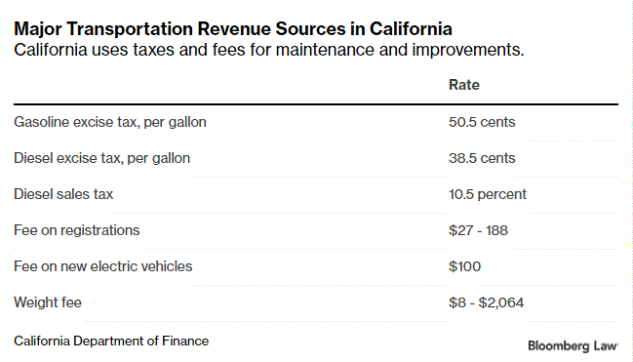

But opponents are concerned the legislation is laying the groundwork for a. The state gasoline tax of 529 cents per gallon could be replaced with a miles driven. Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee.

California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg according. A new bill going through Sacramento would tax drivers for every mile they are on the road.

Please visit our State of Emergency Tax Relief page for additional information. The bill would require the Transportation Agency to consult with appropriate state agencies to implement the pilot program and to design a process for collecting road charge. The 305 billion transportation bill approved by Congress last year included a package of offsets from other areas of the federal budget that totaled.

The California legislature passed a bill extending a road usage charge pilot program. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

Navigating Speed Bumps To A Possible Federal Vehicle Miles Traveled Fee Rand

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

Everything You Need To Know About Claiming A Mileage Tax Deduction

Secured Property Taxes Treasurer Tax Collector

Does Biden S Infrastructure Bill Include A Mileage Tax Or Driving Tax Foundation For Economic Education

Stride Mileage Tax Tracker On The App Store

Reform California Opposes Savings Tax Proposal Reform California

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

Biden Infrastructure Bill Is There A Mileage Fee Wusa9 Com

California Tests Mileage Fee Plan As Answer To Dwindling Gas Tax

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Mileage Log Template Free Excel Pdf Versions Irs Compliant

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

Irs Mileage Reimbursement 2022 Everything You Need To Know About

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

How To Collect Pay Per Mile Road Tax With Connected Cars Smartcar Blog